Graham Fraser

Technology Reporter

Getty Images

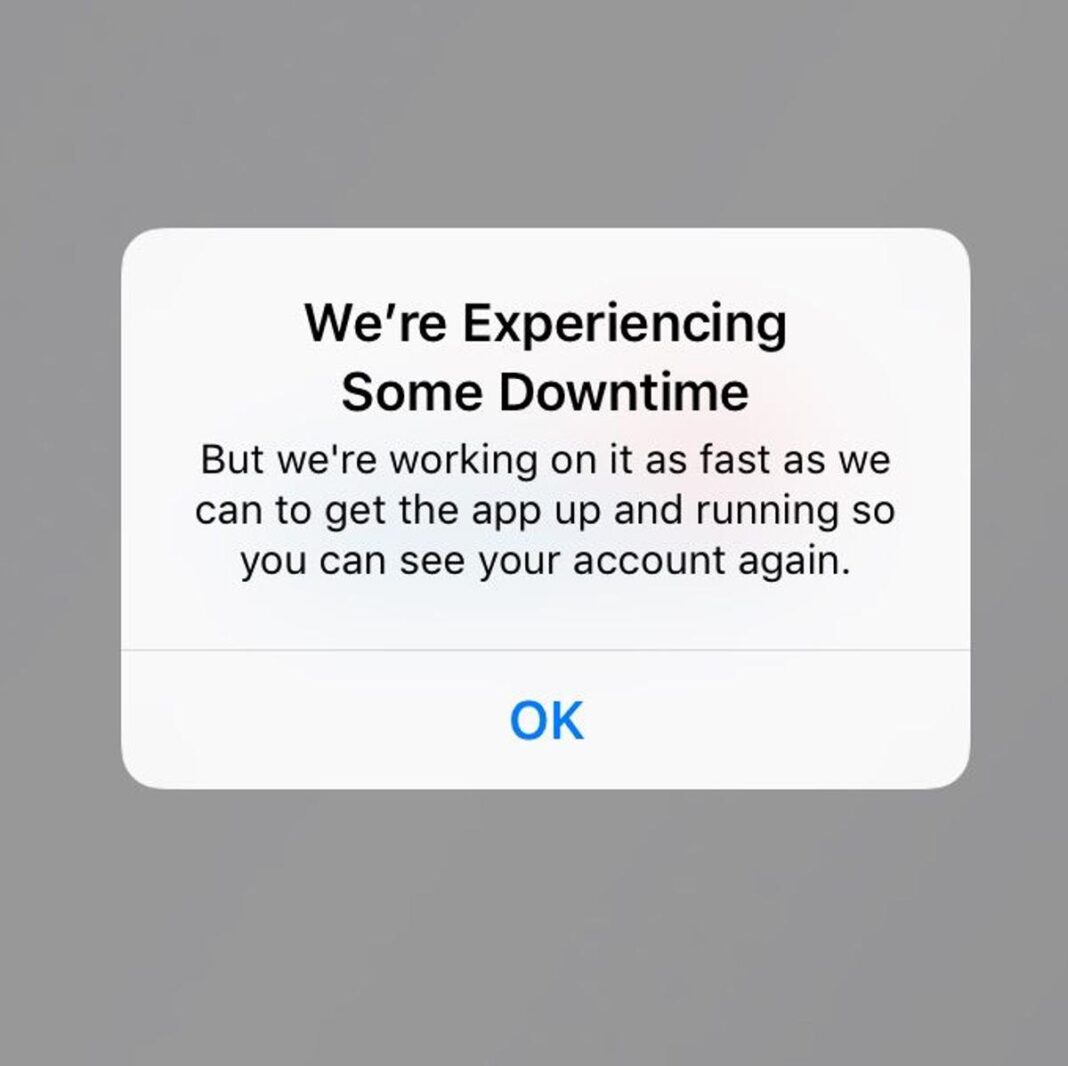

About 1.2m people in the UK were affected by banking outages that happened on what was pay day for many earlier this year.

The details have emerged in letters from Lloyds, TSB, Nationwide and HSBC to Dame Meg Hillier, the chair of the Commons Treasury Committee, which is looking into the incident that occurred on Friday, 28 February.

HSBC also revealed that customers had to wait two hours on average that day to reach its online customer service team. Its standard target wait time is five minutes.

In their correspondence, the banks said they had paid compensation to affected customers and also outlined what they were doing to try to prevent similar problems in the future.

Pay day problems

Lloyds Banking Group customers faced the biggest impact from the February outages.

Ron van Kemenade, the bank’s group chief operating officer, said around 700,000 people who are customers of Lloyds, Halifax, Bank of Scotland and MBNA were affected as they couldn’t log into their accounts on a first attempt.

However Mr van Kemenade argued it did not amount to an outage, as there were five million successful logins during the period of disruption.

Nonetheless, the bank said it was improving its log-in infrastructure and monitoring systems following the incident.

The letters from the banks revealed about 250,000 TSB customers, 196,255 from Nationwide and 60,000 from HSBC also faced disruption on that morning.

The banks have paid out over £114,000 in compensation to customers so far, with Nationwide (£84,341) paying the most.

All the banks said there was no evidence of an increase in fraudulent activity during the disruption, and said there was also no indication that outages were more prevalent at some times – such as pay days – than at other periods.

Fine and failing infrastructure

The pay day outage was far from the only IT problem the banking sector has experienced.

In March, it emerged that nine major banks and building societies operating in the UK accumulated at least 803 hours – the equivalent of 33 days – of tech outages in the past two years.

The Treasury Committee – which has been investigating the impact of banking IT failures – compelled Barclays, HSBC, Lloyds, Nationwide, Santander, NatWest, Danske Bank, Bank of Ireland and Allied Irish Bank to provide the data.

The report also said Barclays could now face compensation payments of £12.5m following an outage there that affected customers on pay day in January.

Experts including Patrick Burgess of BCS, the Chartered Institute for IT, and Shilpa Doreswamy, a director with GFT, a company committed to the digital transformation of the financial sector, have stated that the recent outages reveal the problems banks have with ageing infrastructure and failing IT systems.

Ms Doreswamy told the BBC on Thursday that payday outages were “not just a case of unfortunate timing” but also predictable, preventable events.

“They’ve highlighted the need for banks to invest in IT modernisation to prevent the eroding of customer trust,” she said.

Not acting to reduce the possibility of downtime or frustration for customers – particularly during high-demand periods – could potentially see banks risk their reputation and losing customers, Ms Doreswamy added.

“When customers can’t access their wages, pay bills or run their businesses, the impact is not just financial, it becomes deeply personal.”

Additional reporting by Liv McMahon